Standard Operating Procedure for GST Sales & Purchase Preparing Process:

GST - Goods and Services Tax

SGST - State Goods and Services Tax

CGST - Central Goods and Services Tax

IGST - Integrated Goods and Services Tax

- While Preparing for GST, please refer HDFC Statements & QuickBooks Reports

- Sales need to be send on or before 10th of everything month

- Purchase need to be send on or before 15th of every month

- Once we send the both the sales & purchases to Ponibass Sir Team. They will prepare the challan and send back to us for our review.

- If we pay through bank means, we need take the print out of challan first and then get a sign from Sir with seal.

- And write a Cheque for the same and get a sign from Sir

- And once we submitted to the bank, the bank will process the same.

- Ensure that our account has a sufficient amount

- Once done please inform to Ponibass Sir team

- Or else if we transfer to Ponibass Sir (ICICI Bank) account means, he will take care of everything

- Follow up with them regarding the filing

- Tax need to be paid on or before 20th of every month. Otherwise they will charge as penalty for a every single day

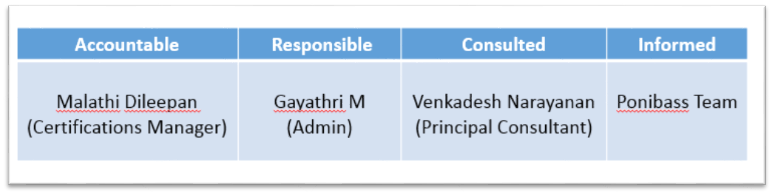

RACI Matrix

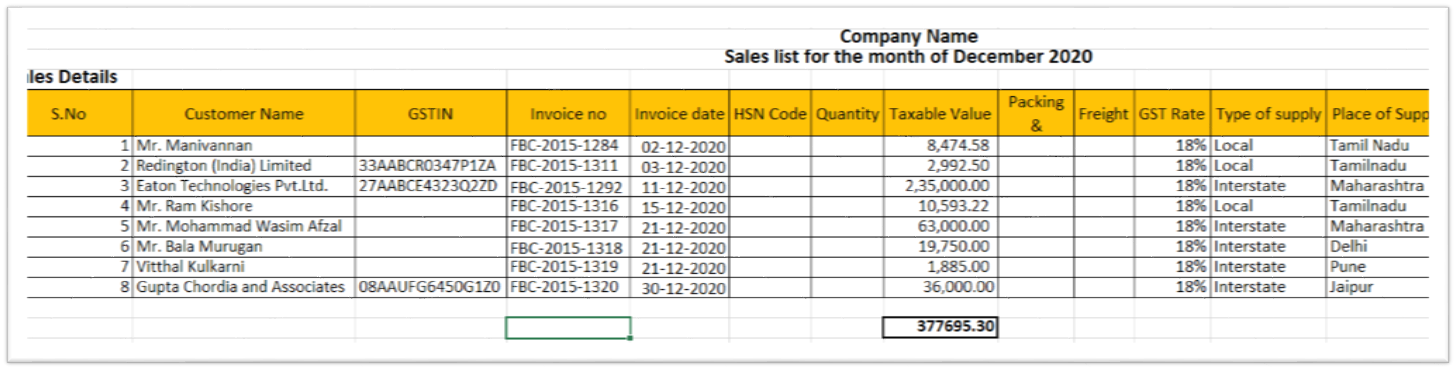

GST Sales:

- Take all the Sales’s GST of the particular month ( refer the HDFC Statements & QuickBooks Reports)

- Need to enter the customer’s Full Name which as same as Invoice in Customer Name Column

- If it is corporate means their correct GST Number is must in GSTIN Column

- Then enter the Invoice Date

- Then the Taxable Value as Base Value (before GST)

- Then the GST rate 18% to all

- Then the Type of Supply as available in 2 Option. One is Local. Another one is Interstate

- Local – within Tamil Nadu

- Interstate – Outside Tamil Nadu

- If the type of supply is Local means Just enter Tamil Naduin Place of Supply Column

- Or Else if the type of supply is Interstate means enter their city name in that column

- If the Type of Supply is Local within Tamil Nadu we need to take as CGST & SGST

- Or Else if the type of supply is Interstate means we need to as IGST

- For CGST & SGST, we need to split the 18% into 9% for CGST & 9% for SGST

- In case of IGST, enter the entire 18% in IGST Column

- Then add the total of the taxable value

- Once done we please verify with Sir and send to Ponibass Sir team

Sales Preparation Example

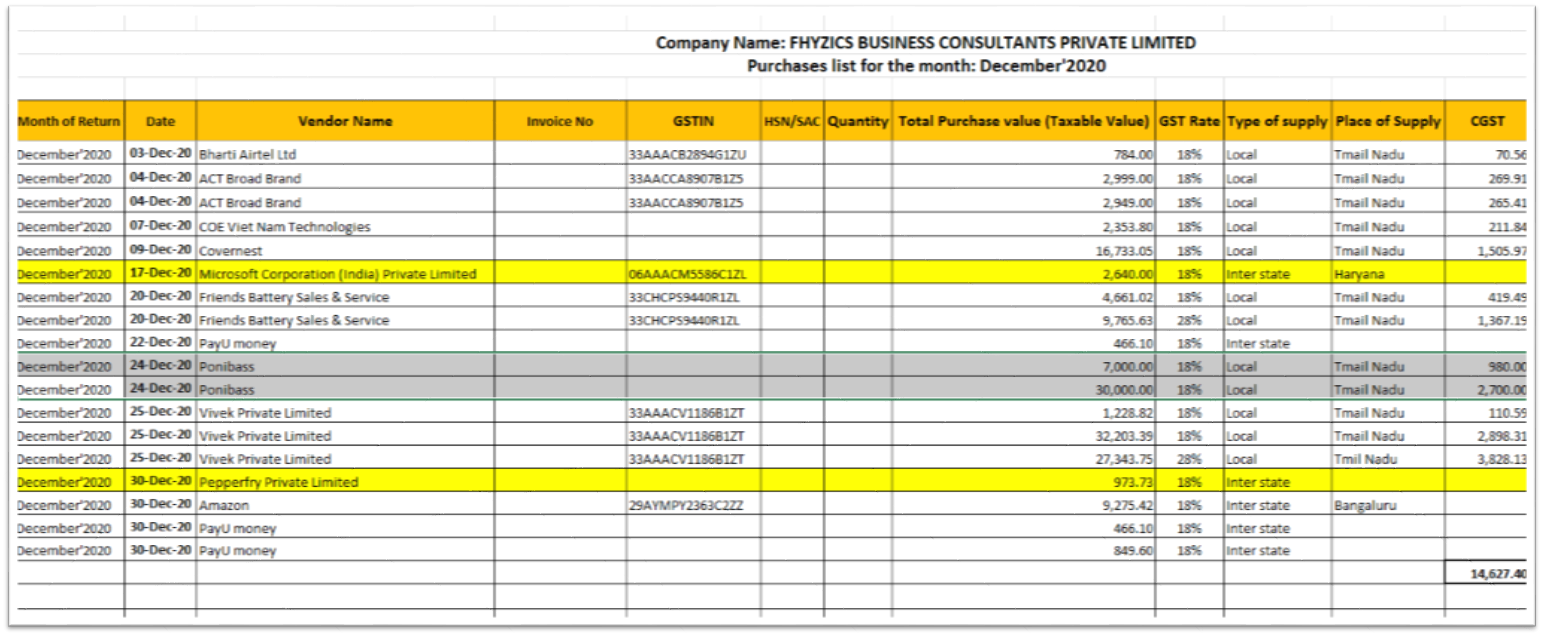

GST Purchases:

- Take the GST as input in all the purchase of the particular month

- Enter the Month of Return

- Then Enter the purchase date in Date Column

- Enter the vendor name, Invoice Number, GST Number

- Enter the Base Value ( before the Tax)

- Enter the GST Rate

- Enter the Type of Supply

- Enter the Place of Supply

- Once done all the process and then add the total of the taxable value

- Once done please calculate GST which we need to pay for the month

Formula as below

GST = Sales – Purchase - Once done please verify with sir and send to Poniboss Sir Team

Purchases Preparation Example

.jpg)